Normal Account Balances

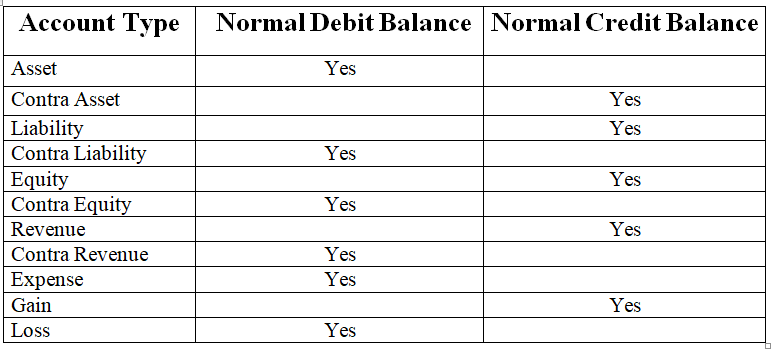

The debit or credit balance that would be expected in a specific account in the general ledger. For example, asset accounts and expense accounts normally have debit balances. Revenues, liabilities, and stockholders’ equity accounts normally have credit balances. A normal balance is an expectation that a particular type of account will have either a debit or a credit balance based on its classification within the chart of accounts. It is possible for an account expected to have a normal balance as a debit to actually have a credit balance, and vice versa, but these situations should be in the minority. The normal balance for each account type is noted in the following table.

A contra account contains a normal balance that is the reverse of the normal balance for that class of account. The contra accounts noted in the preceding table are usually set up as reserve accounts against declines in the usual balance in the accounts with which they are paired. For example, a contra asset account such as the allowance for doubtful accounts contains a credit balance that is intended as a reserve against accounts receivable that will not be paid. The contra equity account usually refers to treasury stock, which is stock that has been bought back by the company, and so carries a normal balance that is the reverse of the normal balance for an equity account.

There are several possible reasons why an account might contain a balance that is the reverse of its normal balance, such as:

- A journal entry was incorrectly recorded in the wrong account.

- An entry reverses a transaction that was in a prior year, and which has already been zeroed out of the account.

- An offsetting entry was recorded prior to the entry it was intended to offset.

Normal Balance and the Accounting Equation

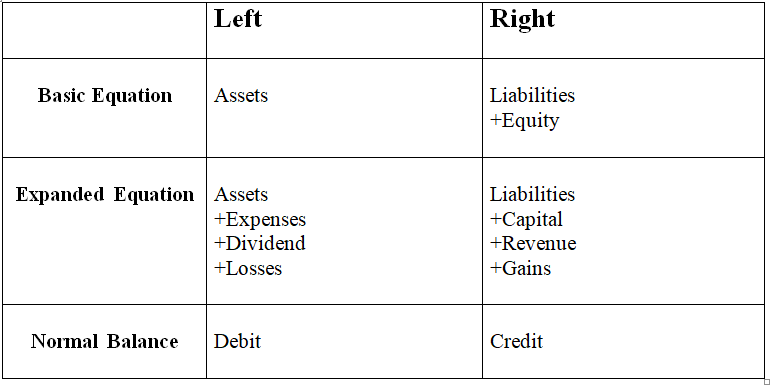

The basic accounting equation can be stated as follows:

- Assets = Liabilities + Equity

This can be developed into the expanded accounting equation as follows.

- Assets + Expenses + Dividends + Losses = Liabilities + Capital + Revenue + Gains

Debit simply means on the left side of the equation, whereas credit means on the right-hand side of the equation as summarized in the table below.

For this reason, the account balance for items on the left-hand side of the equation is normally a debit and the account balance for items on the right side of the equation is normally a credit.

Normal Balance Examples

From the table above it can be seen that assets, expenses, and dividends normally have a debit balance, whereas liabilities, capital, and revenue normally have a credit balance.

By identifying the type of account (asset, liability, etc.) and establishing which side of the accounting equation it is on (left or right), it is possible to determine whether the account would normally have a debit or a credit balance.

To understand the concept of the normal balance considers the following examples in relation to the table above.

- Accounts payable normal balance: Accounts payable is a liability on the right side of the accounting equation and is normally a credit balance.

- Accounts receivable normal balance: Accounts receivable is an asset on the left side of the accounting equation and is normally a debit balance.

- Cash normal balance: Cash is an asset on the left side of the accounting equation and is normally a debit balance.

- Common stock normal balance: Common stock is part of the capital on the right side of the accounting equation and is normally a credit balance.

- Cost of goods sold normal balance: Cost of goods sold is an expense on the left side of the accounting equation and is normally a debit balance.

- Dividends normal balance: A dividend is on the left side of the accounting equation and is normally a debit balance.

- Inventory normal balance: Inventory is an asset on the left side of the accounting equation and is normally a debit balance.

- Retained earnings normal balance: Retained earnings are part of the equity of the business on the right side of the accounting equation and are normally a credit balance.

- Gains on the sale of fixed assets: A gain on the sale of fixed assets is on the right side of the accounting equation and is normally a credit balance.

- Losses on the sale of fixed assets: A loss on the sale of fixed assets is on the left side of the accounting equation and is normally a debit balance.

Using the Normal Balance

Although each account has a normal balance in practice it is possible for an account to have either a debit or a credit balance depending on the bookkeeping entries made.

The benefit of knowing the normal balance is that if an account shows a balance other than its normal balance, for example, an inventory account with a credit balance, it is a good indication that there might be an error on the account and further investigation may be needed.

It should be noted that if an account is normally a debit balance it is increased by a debit entry, and if an account is normally a credit balance it is increased by a credit entry. So for example a debit entry to an asset account will increase the asset balance, and a credit entry to a liability account will increase the liability.

You may also like General Ledger

Leave a Reply