Legal Requirements of Accounting

Accounting Requirements means the requirements of any system of accounts prescribed by a regulatory authority having jurisdiction over the Company or, in the absence thereof, the requirements of generally accepted accounting principles applicable to similar Persons conducting businesses similar to that of the Company. The books of accounting of the group companies must contain: It must reflect the true and clear statements of the state of affairs of the company or the group of companies and also explain the transactions. The books must be kept on an accurate basis and according to the double-entry system of accounting.

Provisions of Company Act Relating to Accounting

According to company Act 2063 section, 109 preparation of Annual financial statement and report shall be prepared by the board of directors of a public company every year at least thirty days prior to the holding of its annual general meeting, and in the case of a private company, within six months of the expiry of its financial year:

- A balance sheet as the last date of the financial year.

- Profit and loss account of the financial year.

- Description of cash flow of the financial year.

Introduction to accounting standards (IFRS and NAS)

International Financial Reporting Standards-IFRS

International Financial Reporting Standards (IFRS) set common rules so that financial statements can be consistent, transparent, and comparable around the world. IFRS is issued by the International Accounting Standards Board (IASB). They specify how companies must maintain and report their accounts, defining types of transactions, and other events with financial impact. IFRS was established to create a common accounting language so that businesses and their financial statements can be consistent and reliable from company to company and country to country.

IFRS is designed to bring consistency to accounting language, practices and statements, and to help businesses and investors make educated financial analyses and decisions. The IFRS Foundation sets the standards to “bring transparency, accountability, and efficiency to financial markets around the world… fostering trust, growth, and long-term financial stability in the global economy.” Companies benefit from the IFRS because investors are more likely to put money into a company if the company’s business practices are transparent.

Nepal Accounting Standards-NAS

The Accounting Standards Board (ASB) is an independent statutory body with the responsibility to set accounting standards for the preparation and presentation of financial statements in Nepal. Nepal Accounting Standards (NAS) issued by the ASB as mandated by the Institute of Chartered Accountants of Nepal act 1997, are formulated and revised by the board following the IFRS issued by the International Accounting Standards Board (IASB). The principal objectives of NAS are;

- to formulate accounting standards in line with IFRS issued by IASB.

- full discretion in developing and pursuing the technical agenda for setting Accounting Standards in Nepal.

Annual Report

The annual report is a publication issued to a company’s shareholders, creditors, and regulatory organizations following the end of its fiscal year. The report typically contains at least an income statement, balance sheet, statement of cash flows, and accompanying footnotes. It may also contain a letter to shareholders, management comments, an audit report, and various supporting schedules that may be required by regulatory organizations. This document used to be a major product of the investor relations department, but it has declined in importance over time.

Major Components

The components of an annual report are mentioned below:

- Set of Financial Statements

- External Auditor’s Report

- Report of Chairperson

- The Report of the Board of Directors

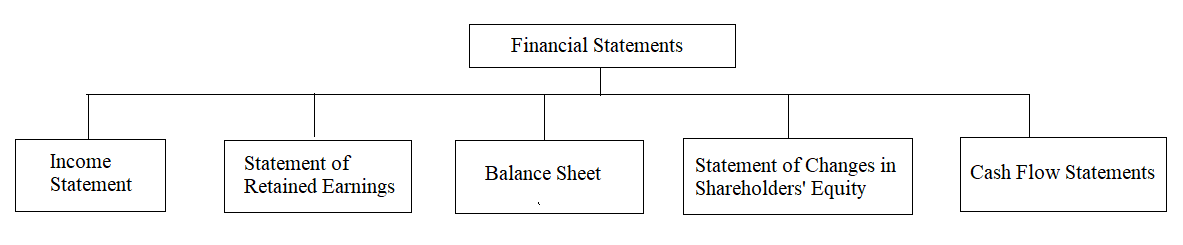

Basic components of Financial Statements

Income Statement

The income statement is the “what did we do” statement. The income statement, or profit and loss statement, shows how the company performed during the course of its operations for a fixed period of time. It accumulates information over a set period (typically annually, monthly or quarterly). Key elements of the income statement include revenue and expenses. Combined, these numbers yield the net income (or loss).

Statement of Retained Earnings

The statement of retained earnings is a measure of the assets of your operation that have been generated through profitable activity, retained in your business, and not paid out to shareholders as dividends. Generally, a large amount of retained earnings is regarded as a sign that the company has done well and is reinvesting its profits in itself. That said, a startup or early-stage business often faces reporting negative retained earnings as it takes time to build a business and become profitable.

Balance Sheet

The balance sheet is the critical “what do we have” statement. The balance sheet shows what the company owns (assets such as cash, accounts receivable, and equipment) and what the company owes (liabilities such as accounts payable and loans). Any remaining difference between these two amounts (the assets and the liabilities) shows what belongs to the owners as their equity interest. These three amounts should always be in balance (see the fundamental accounting equation). The balance sheet presents a picture of where the company is at a certain point in time.

Statement of Changes in Shareholders’ Equity

A statement of changes in shareholders’ equity presents a summary of the changes in shareholders’ equity accounts over the reporting period. It reconciles the opening balances of equity accounts with their closing balances.

There are two types of changes in shareholders’ equity:

- changes that originate from transactions with shareholders such as the issue of new shares, payment of dividends, etc. and

- changes that result from changes in total comprehensive income, such as net income for the period, revaluation of fixed assets, changes in fair value of certain investments, etc.

Cash Flow Statements

The cash flow statement shows the sources and uses of cash for a fixed period of time. The cash flow statement informs investors and creditors about the solvency of your business, where the business is receiving its cash from, and on what it is spending its cash.

Accounting Policies and Notes

Accounting policies are a set of standards that govern how a company prepares its financial statements. … These policies may differ from company to company, but all accounting policies are required to conform to generally accepted accounting principles (GAAP) and/or international financial reporting standards (IFRS). Accounting policies are the internal policies set by the entity to process, measure, recognize, record, as well as disclose the specific items or transactions in its financial statements.

Accounting policies might be different from one company to another; however, those policies are tailor to meet the specific International Accounting Standard or other standard bodies like local standards or regulations related to the purpose of financial reporting. To ensure this, the companies setting up their own procedures and manuals to ensure the consistency of practices and to make sure that their accounting records are compliant with those accounting standards or local regulations.

To make sure financial statements of the company are preparing in accordance with specific accounting standards or regulations, accounting policies have to tailor specifically link with the company’s operation and accounting standards.

You may also like Use of computers in accounting process

Leave a Reply