Accounting Transaction

Accounting transactions refer to any business activity that results in a direct effect on the financial status and financial statements of the business. Such transactions come in many forms, including:

- Sales in cash and credit to customers

- Receipt of cash from a customer by sending an invoice

- Purchase of fixed assets and movable assets

- Borrowing funds from a creditor

- Paying off borrowed funds from a creditor

- Payment of cash to a supplier from a sent invoice

The Accounting equation and Analysis of Transactions

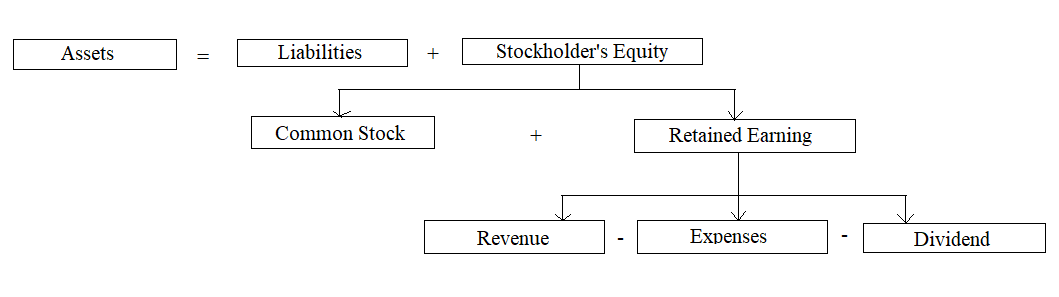

The first step in the accounting process is to analyze every transaction (economic event) that affects the business. The accounting equation (Assets = Liabilities + Owner’s Equity) must remain in balance after every transaction is recorded, so accountants must analyze each transaction to determine how it affects the owner’s equity and the different types of assets and liabilities before recording the transaction.

Six Steps of Accounting Transaction Analysis

1. Determine if the event is an accounting transaction

You first need to determine whether this transaction is a business nature transaction. An accounting also transaction has to involve a monetary amount. So if the company signed a rental contract, there is no accounting transaction. However, if it makes a payment under this contract, it will be an accounting transaction because it has a monetary amount that the company will need to record. Other examples include the purchase of equipment, sale of products, and salary payments.

2. Identify what accounts it affects

Your next step is to identify which accounts the transaction will affect. For example, Ellen invested $38,000 in cash and a used truck with a market value of $8,500 in the business in exchange for the company’s common stock. The cash and truck invested will be assets for that business, recorded under the Cash account and Truck account. In exchange for that investment, Ellen will get common stock, so it will also affect the Common Stock account.

3. Determine what type of accounts they are

Every transaction leads to a measurable change in the accounting equation. Knowing whether the account belongs to assets, liabilities, or equity will allow you to determine whether the account will have a debit or credit normal balance. In the example above, we already decided that two accounts will be Asset accounts, and the Common Stock account is the Owner’s Equity type account.

4. Determine which accounts are going up or down

A business records a transaction with an entry that has a debit and credit effect. This double-entry procedure keeps the accounting equation in balance. So, when Ellen invested cash, the cash and truck accounts will increase because the company will now have more money, and it now has a truck. The Common Stock account will also increase.

5. Apply the rules of debits and credits to these accounts

One has to record each business transaction in two or more related but opposite accounts. We debit one account and credit the other Account in the same transaction amount. Accounts on the left side increase with a debit entry and decrease with a credit entry while accounts on the rise on the right side with a credit entry and decrease with a debit. So, if the Cash and Truck accounts will increase, and it is an asset account, the business will debit it. The Common Stock account is the Equity account, which increases with a credit entry.

6. Find the transaction amount to be entered into each account

Your final step would be to determine the amount of the transaction from the business records, such as receipts, invoices, and bank statements.

The Role of Source Documents

The source document is good internal control and provides evidence a transaction occurred. Providing source documents to your bookkeeper or accountant in a timely manner assists them in the preparation of financial statements and accurately analyzing your business activity. The source document is essential to the bookkeeping and accounting process as it provides evidence that a financial transaction has occurred. During an accounting or tax audit, source documents back up the accounting journals and general ledger as an indisputable transaction trail. In the accounting industry, source documents include receipts, bills, invoices, statements, checks – i.e., anything that documents a transaction. Any time a business spends or receives money, a source document is created.

When a business generates a financial transaction, it creates a paper trail. This paper trail is called a “Source Document.” Your bookkeeper or accountant may ask you to provide them with some sort of source document to verify data and record transactions correctly. A good source document should describe the basic facts of the transaction such as the date, the amount, the purpose, and all parties involved in the transaction.

You may also like The Basic for Recording Transactions

Leave a Reply