Petty Cash, Balance Sheet Presentation of Cash and Cash Equivalent

Petty cash is a part of an organization’s cash in hand, specifically used for day-to-day small expenditures. This amount is used for all the expenses for which it is too hard to issue checks and records their trail. These expenses have not material effect and generally did not require a high level of authentication for its payment. Most of the organizations have set a limit for petty cash account and petty cash expenses. So that the operations will run smoothly without disturbing the daily routine.

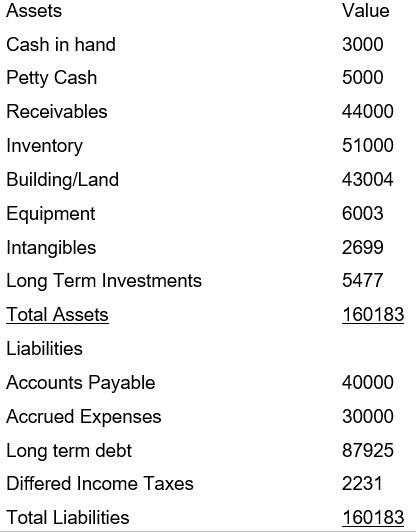

The account will be shown in the balance sheet under the head of current assets. Or you can merge this account with the cash in hand account of the entity. The other financial statement where the amount is used is the statement of cash flow.

Usage

Petty cash is used for small purchases of day-to-day business. Following are some examples:

- Payment for daily postage expenses

- Payment for daily supplies

- Payment for daily kitchen expense

Accounting

Rules of accounting are just like the general rules applied on the cash account. It will be treated as a current asset of the company and would apply all the debit and credit rules used for current assets.

Presentation of Petty Cash Account in Balance Sheet

The company’s financial statements are mainly of 4 types. Each statement has its own purpose and presentation form. The main common 4 types are:

- Balance Sheet

- Income Statement

- Cash flow statement

- Changes in Owner’s Equity

The account will be shown in the balance sheet under the head of current assets. Or you can merge this account with the cash in hand account of the entity.

And thus present in the balance sheet. The hierarchy will be like this in the balance sheet

Total Assets

- Non-Current Assets

- Current Assets

- Cash And Cash Equivalents

- Cash

- Cash In Hand

- Petty Cash

Let’s have a look of it in balance sheet

You may also like Preparation of the bank reconciliation statement

Leave a Reply