Cash versus accrual basis of Accounting

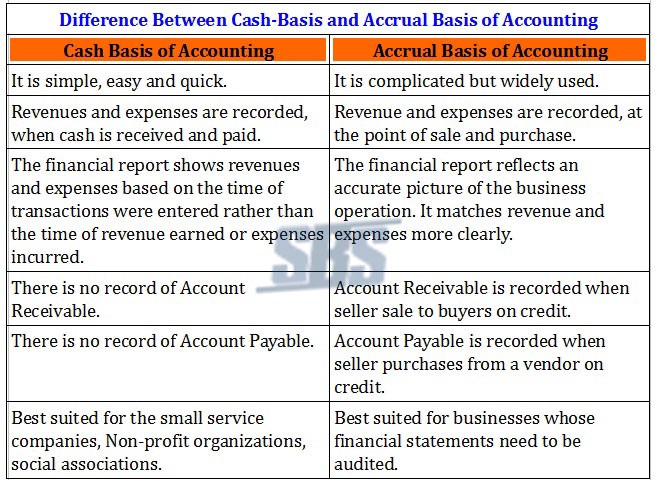

Accrual accounting means revenue and expenses are recognized and recorded when they occur, while cash basis accounting means these line items aren’t documented until cash exchanges hands. The accrual method is the most commonly used method, especially by publicly-traded companies as it smooths out earnings over time. The main difference between accrual and cash basis accounting lies in the timing of when revenue and expenses are recognized. The cash method is a more immediate recognition of revenue and expenses, while the accrual method focuses on anticipated revenue and expenses.

Accrual Accounting Method

Revenue is accounted for when it is earned. Typically, revenue is recorded before any money changes hands. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future. Expenses of goods and services are recorded despite no cash being paid out yet for those expenses.

Cash Basis Accounting

Revenue is reported on the income statement only when cash is received. Expenses are only recorded when cash is paid out. The cash method is mostly used by small businesses and for personal finances.

Key Differences

The key advantage of the cash method is its simplicity—it only accounts for cash paid or received. Tracking the cash flow of a company is also easier with the cash method.

But a disadvantage of the cash method is that it might overstate the health of a company that is cash-rich but has large sums of accounts payables that far exceed the cash on the books and the company’s current revenue stream. An investor might conclude the company is making a profit when, in reality, the company is losing money.

Meanwhile, the advantage of the accrual method is that it includes accounts receivables and payables and, as a result, is a more accurate picture of the profitability of a company, particularly in the long term. The reason for this is that the accrual method records all revenues when they are earned and all expenses when they are incurred.

For example, a company might have sales in the current quarter that wouldn’t be recorded under the cash method because revenue isn’t expected until the following quarter. An investor might conclude the company is unprofitable when, in reality, the company is doing well.

The disadvantage of the accrual method is that it doesn’t track cash flow and, as a result, might not account for a company with a major cash shortage in the short term, despite looking profitable in the long term. Another disadvantage of the accrual method is that it can be more complicated to implement since it’s necessary to account for items like unearned revenue and prepaid expenses.

Accrual Accounting vs. Cash Basis Accounting Example

Let’s say you own a business that sells machinery. If you sell $5,000 worth of machinery, under the cash method, that amount is not recorded in the books until the customer hands you the money or you receive the check. Under the accrual method, the $5,000 is recorded as revenue immediately when the sale is made, even if you receive the money a few days or weeks later.

The same principle applies to expenses. If you receive an electric bill for $1,700, under the cash method, the amount is not added to the books until you pay the bill. However, under the accrual method, the $1,700 is recorded as an expense the day you receive the bill.

You may also like Adjusting Entries

Leave a Reply