Input Pricing under Bilateral Monopoly

Meaning of Bilateral Monopoly:

Bilateral monopoly refers to a market situation in which a single producer (monopolist) of a product faces a single buyer (monopolist) of that product. We analyze below price, output and profit determination under bilateral monopoly.

Its Assumptions:

1. There is a single commodity with no close substitutes.

2. The monopolist is its sole producer or seller.

3. The monopolist is its only buyer.

4. The monopolist and the monopolist are both free to maximize their own individual profits.

Price-Output Determination of Bilateral Monopoly:

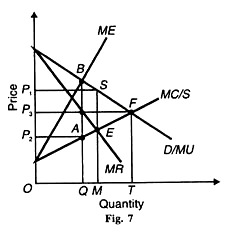

Given these assumptions, price and output determination under bilateral monopoly is illustrated in Figure 7 where D is the demand curve of the monopolist’s product and MR is its corresponding marginal revenue curve of the monopolist. The MC curve of the monopolist is the supply curve (S) facing the monopolist. The upward slope shows that if the monopolist wants to buy more, he will have to pay a higher price.

So when he buys more units of the product, his marginal outlay or marginal expenditure increases. This is shown by the upward sloping ME curve which is the marginal expenditure curve to the total supply curve MC/S. The curve D is the marginal utility (MU) curve of the monopolist.

Let us first take the equilibrium position of the monopolist. The monopolist is in equilibrium at point E where his MC curve cuts the MR curve from below. His profit-maximizing price is OP1 (=MS) at which he will sell the OM quantity of the product.

The monopsonist is in equilibrium at point В where his marginal expenditure curves ME intersects the demand cure D/MU. He buys OQ units of the product at OP2 (=QA) price, as determined by point A on the supply curve MC/S.

So there is disagreement over price between the monopolist who wants to charge a higher price OP; and the monopsonist who wants to pay a lower piece OP1 From a theoretical viewpoint, there is indeterminacy in the market.

In actuality, the actual quantity of the product sold and its price depends upon the relative bargaining strength of the two. The greater the relative bargaining strength of the monopolist, the closer will price be to OP1 and the greater the relative strength of the monopsonist, the closer will price be to OP. Thus the price will settle somewhere between OP1 and OP2.

If the monopoly and monopsony firms merge into a single firm with the monopsonist taking over the monopoly firm, the МС/S curve of the monopsonist becomes his marginal cost curve. The merged firm would thus maximize its profits at point F where its MC/S curve cuts the D/MU curve.

It will supply and use ОТ output at OP3 price. In this situation, the merged firm gets a much larger output (ОТ) than the monopoly output (OM) at a lower price (OP3) than the monopoly price (OP1).

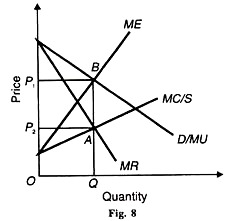

However, it may not be possible to merge the monopoly firm with the monopsony firm. Economists have suggested another solution to the problem of bilateral monopoly that of join profit maximization. In this case, the monopolist and monopsonist agree on the quantity to be sold and bought to each other but disagree on the price to be charged. On this basis, they want to maximize joint profits because they feel that they have got information about each other’s wants and aspirations.

This case is illustrated in Figure 8 where the monopolist is in equilibrium at A when his MC/S curve = MR curve. He wants to sell OQ quantity at OP1 (=QB) price. On the other hand, the monopsonist is in equilibrium at point В when his demand curves D/MU = ME curve.

He wants to buy OQ quantity at OP2 price. Depending on the relative bargaining strength of each, the price can be anywhere between P2 and P1 and is thus indeterminate. But their joint profits are P1P2 × OQ that can be divided between the monopolist and the monopsonist in the ratio

Px-P2 P1-PX PX -P2

P1-P2 P1– P2 P 1 – Px

Where Px is any price between P2 and P1.

These are the conceptual notes of Input Pricing under Bilateral Monopoly

You may also like: Concept of Market Economy

Leave a Reply