Substitution Effect

A change in the relative prices of goods, make a rational consumer induce to substitute a relatively cheaper commodity for the dearer one. Such an effect of the change in relative prices of goods is described as the substitution effect. For example, when the price of goods rises, it becomes more expensive in terms of other goods in the market. As a result, consumers switch away from the good towards their substitutes. The pure substitution effect is measured by rearranging the purchases made by the consumer as a result of the change in the relative price of goods, his real income remaining constant, in such a way that his level of satisfaction will remain as before.

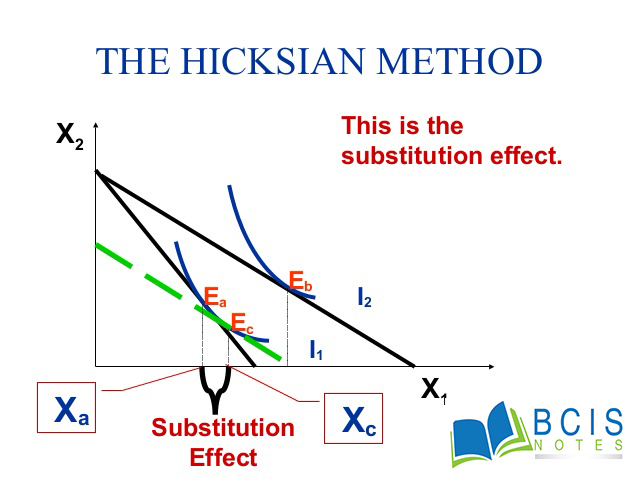

Hicksian Approach

- According to the Hicksian method, the consumer’s real income is so adjusted after the fall in the price of commodity X that income adjusted budget line is tangent to the original budget line. That is consumer’s real income is so adjusted that he returns to his original indifference curve, no matter if his consumption changes.

In the figure, let E1 be the initial equilibrium position of the consumer, where the budget line be AB is tangent to IC1. This equilibrium shows that the consumes ON1 of Y good and OQ1 of X good. When the prices of X falls, while that of price Y and money income of the consumer remain unchanged, the budget line shifts rightwards from AB to AC. To measure pure substitution effect however we have to resort to compensation variation in income by changing the tax rate. The budget line shifts leftwards as parallel to AC to EF and tangential to the original IC1 so that the consumer is placed back on the ordinal level of satisfaction, maintaining the same real income as before. However, with respect to the EF budget line, though the consumer is brought back on the same IC1 his equilibrium position has changed from E1 to E3. It is due to the comparison of the relative prices of two goods. New equilibrium E3 shows that he consumes OQ2 units of X good. Here he substitutes Q1Q2 units of cheaper good X for N1N2 units of dear good Y. this process is also called the substitution effect.

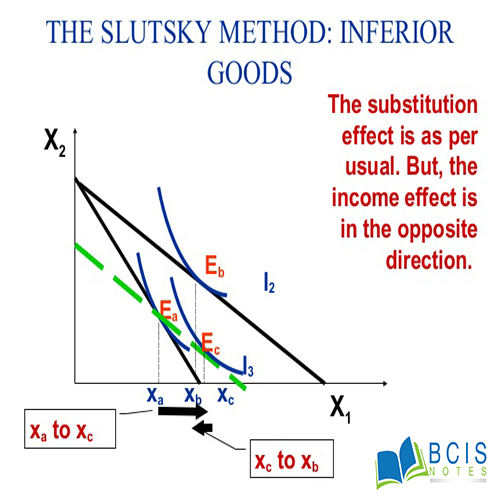

Slutsky Approach

- Slutsky suggested that consumer’s income should be so adjusted that the consumer not only returns to his original indifference curve but also to the point of his original equilibrium, i.e. he is able to buy his original combination of two goods after the change in price ratio. That is, the consumer’s income adjusted budget line must pass through his initial equilibrium point on the original indifference curve.

In the figure, AB1 is the initial budget line. The consumer’s original equilibrium is E1, where indifference curve IC1 is tangent to the budget line AB1. Suppose the price of commodity X falls and other things remain the same. Now the consumer shifts to another equilibrium point E2, where indifference curve IC3 is tangent to the new budget line AB2. Consumer’s movement from equilibrium point E1 to E2 implies that consumer’s purchase of commodity X increases by X1X2. This is the total price effect caused by the decline in the price of commodity X. In the figure, this is illustrated by drawing a new budget line A4B4, which passes through original equilibrium point E1 but is parallel to AB2. This means that we have reduced the consumer’s money income by AA4 or B4B2 to eliminate the income effect. Now the only possibility of price effect is the substitution effect. Because of this substitution effect, the consumer moves from equilibrium point E1 to E3, where indifference curve IC¬2 is tangent to the budget line A4B4. In the Slutsky method, the substitution effect leads the consumer to a higher indifference curve.

You may also like: Price Effect

Leave a Reply